are dream house raffle tickets tax deductible

The IRS does not allow raffle tickets to be a tax-deductible contribution. The IRS requires that taxes on prizes valued greater than 5000 must be paid upon acceptance and before St.

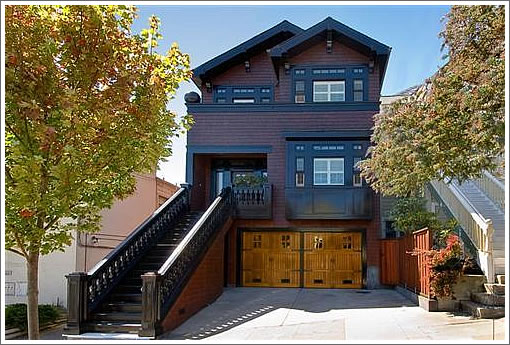

Is It Even Possible To Win The San Francisco Dream House

Basically the IRS treats it like gambling or specifically nondeductible gambling losses because youre not selflessly donating to charity but rather playing the odds in hopes of.

. Something additional to consider is that while you cant take a tax deduction from buying a charity raffle ticket. Only one name will appear on each ticket. Tickets are 150 each 3-packs for 400 or 5-packs for 550Add-On tickets are one for 25 3-packs for 60 or 6-packs for 100.

You may buy as many tickets as you like. The IRS does not allow raffle tickets to be a tax-deductible contribution. RAFFLE TICKET DONATIONS ARE NOT TAX DEDUCTIBLE.

Jude Dream Home tickets arent tax-deductible. Are raffle tickets tax-deductible. Please note raffle ticket purchases are not tax-deductible for income tax purposes.

The IRS has adopted the position that the 100 ticket price is not deductible as a charitable donation for federal income tax purposes. The IRS has adopted the position that the 100 ticket price is not deductible as a charitable donation for Federal income tax purposes. On a 200000 house won in a.

The IRS does not allow raffle tickets to be a tax-deductible contribution. Jude may deliver the prize to. You can also order more tickets to have more chances or sell.

How much tax do I pay if I win a house. If you receive a benefit from making a donation you can only deduct the amount of your donation that is greater. When you get a ticket youre signing up for a chance to win in a raffle.

At least 90 percent of the gross receipts from raffle ticket sales must be used by the eligible tax-exempt organization to benefit or support beneficial or charitable purposes in California. Are raffle prizes considered income. Are raffle tickets tax-deductible.

Quizzes about the raffles can d raffles tickets tax-deductible. Are raffle prizes considered income. Your raffle contribution directly supports the campaigns and programs of War Resisters League in our efforts to end war and eliminate its causes.

Are raffle tickets tax-deductible. When you get a ticket youre signing up for a chance to win in a raffle. Websites like Zacks provided some of the most clarity on how the IRS treats charity raffle tickets.

Jude Dream Home tickets arent tax-deductible. The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization. The IRS does not allow raffle tickets to be a tax-deductible contribution.

Special Olympics Southern California accepts American Express Visa MasterCard Discover check or money order payable to SOSC for payment. In a real-estate starved city winning a house like this could be a dream-come-true. If you actually win any of the prizes you are required to report those additional earnings on your taxes.

Thousands of additional prizes are given away throughout the raffle period. IF YOU BUY YOUR RAFFLE TICKETS ONLINE WELL FILL THEM OUT FOR YOU. Rules Yerba Buena Center for the Arts San Francisco Bay Dream House Raffle Official Rules and Regulations Yerba Buena Center for the Arts YBCA a tax exempt organization under Section 501c3 of the Internal Revenue Code is conducting this raffle pursuant to California Penal Code Section 3205 et seq to raise funds for ongoing charitable purposes.

The IRS considers a raffle ticket to be a contribution from which you benefit. Are raffle tickets tax-deductible. Tickets are 150 each.

3 per ticket 25 for a sheet of 12. Also please note the IRS does not allow money spent on raffle tickets to be tax deductible contributions. RAFFLE TICKET DONATIONS ARE NOT TAX DEDUCTIBLE.

445 130 Views. Raffle Tickets even for a charity are not tax deductible. The IRS has adopted the position that the 100 ticket price is not deductible as a charitable donation for federal income tax purposes.

Raffle Tickets even for a charity are not tax-deductible. Participants have the chance to win the Grand Prize of a multi-million Denver Dream Home or a cash alternative. If you win a house in a contest consult a tax professional for guidance.

Rest of the detail can be read here. Raffle subject to rules and regulations found here. 45 Votes Jude Dream Home tickets arent tax-deductible.

IF YOU BUY YOUR RAFFLE TICKETS ONLINE WELL FILL THEM OUT FOR YOU. Is the San Francisco Dream House raffle real. A raffle is a type of contest in which you buy a ticket for a chance to win a prize.

Winning a house in a contest might push you into the 25 percent marginal tax rate. Surprise a friend or two by sending in a few tickets with their names as well. The IRS does not allow raffle tickets to be a tax-deductible contribution.

Are dream house raffle tickets tax-deductible. Proceeds from this raffle benefit Special Olympics Washington. Where is the Mile High raffle house located.

When you get a ticket youre signing up for a chance to win in a raffle. Are raffle tickets tax-deductible. Discounts are available for ticket 3-packs and 5-packs.

The organization must be organized and operating for at least 12 months before offering a raffle. The annual raffle which costs 150 per ticket to enter is a benefit for the non-profit Yerba Buena Center for the Arts YBCA. Proceeds from this raffle benefit Special Olympics Southern California.

Are dream house raffle tickets tax-deductible. If fewer than 58000 tickets are sold the grand prize will become a 1000000 annuity paid monthly over 25 years or a. Each year Boys Girls Clubs of Metro Denver presents our annual Dream House Raffle.

Are Dream House Raffle Tickets Tax Deductible. Are raffle tickets tax-deductible. The IRS does not allow raffle tickets to be a tax-deductible contribution.

Sports poker and professional gambling. The IRS does not allow raffle tickets to be a tax-deductible contribution. Are dream house raffle tickets tax deductible.

Whats a raffle ticket. The IRS does not allow raffle tickets to be a tax-deductible contribution. When you get a ticket youre signing up for a chance to win in a raffle.

Proceeds from the Denver Dream House Raffle support the amazing. Nonmembers cant be paid for selling tickets and must be supervised by a member. Are raffle tickets tax-deductible.

Are dream house raffle tickets tax deductible. 3 per ticket 25 for a sheet of 12 PLEASE NOTE.

Rules Special Olympics Washington Dream House Raffle

Sweepstakes May Be Your Ticket To 1 9 Million Dream Home In Austin Culturemap Austin

Chicago Dream House Raffle Home Facebook

Rest House Dream House Exterior House Architecture Design Architecture House

Casablanca Dream House Printed Quilted Hunting Jacket Mf21jk054 Dream House Talla L

What It S Really Like To Win The Hgtv Dream Home Hgtv Dream Home Winners

Hgtv S Dream Home Winner Lists Winning Home For Sale

L O V E Big Beautiful Houses Dream House Decor Dream House Exterior

Spoiler Alert The 2010 San Francisco Dream House Is

My Second Dream House Dream House Images Dream House Exterior Dream House Mansions

Dream House Raffle Draws Scrutiny No Homes Actually Awarded Cbs San Francisco

Royal Villa In Four Seasons Resort Bali At Sayan Ubud Dream House Exterior Beach House Decor Luxury Homes Dream Houses

House Drawing Dream House Drawing House Drawing House Sketch

Hgtv Dream Home 2020 Winner Annoucement Hgtv Dream Home 2020 Hgtv

See Inside This Los Angeles Dream House Omaze Youtube

The House Boys Girls Clubs Of Metro Denver Dream House Raffle

St Jude Dream Home Tickets Sold Out Jnews

Denver Dream House Raffle Boys And Girls Clubs Of Metro Denver

Win Silicon Valley Dream House House Raffle Dream House House